Stranded Assets

Identifying risks includes developing processes to identify the potential of stranded assets and measures to mitigate these increasing risks.

In some ways, the buildings in our portfolio are very similar to our cars. The way we operate them and the maintenance we provide impact the gas mileage and, ultimately, the value of the vehicle.

Now let’s think about how we operate our buildings; the way we operate them is linked to efficiency, as is the equipment we install or maintain within those buildings. When you install a 30,000-mile tire on your car - care to guess how many miles you should expect to get out of that tire? How many 20-year roofs are at year 25 in your portfolio? How many 10-year life expectancy chillers are setting at 15-20 years post installation? Our portfolios’ financial performance is directly related to the attention or inattention we deliver in our operations and what we prepare for during due diligence or development.

I do not believe you will get a lot of arguments around the importance of maintenance, but what about the fuel you use for energy in those assets? The quality of the fuel we put into our vehicles can affect the performance of our vehicles. Back when we had both leaded and unleaded gasoline, what happened when you accidentally put leaded gasoline into an unleaded gasoline engine?

On the subject of leaded gasoline vehicles - how has the value of that leaded gasoline engine held up, especially when the market ceased providing leaded fuel. At that point in time, you literally had a car you could no longer fuel without modifications - you had a stranded asset.

An effective ESG program considers not only the efficiency of the equipment but also the potential for obsolescence. Think it can only happen in cars? Take a look at the natural gas bans already passed across much of California as well as being discussed in DC.

Buildings that rely on fossil fuels have greater exposure to being stranded assets should the economy shift to a non-fossil fuel-based energy supply. Supply and demand work, and if demand is reduced through electrification of the built environment, the cost of natural gas may increase or be abandoned entirely. In addition to the energy supply itself, there are a host of other potential regulatory issues that could impact buildings that rely on this energy source, not to mention impacts on occupancy.

There is also an opportunity in understanding the types of energy our buildings use. These opportunities range from reducing your carbon footprint through smarter procurement strategies to improving the NOI of an asset by reducing the amount of utilities the building wastes.

Let’s address the easy one first. Often ESG programs focus nearly exclusively on operational efficiency. While it is not harmful to focus on efficiency, efficiency is not the only factor to consider. Remember my car analogy? Well, just like your car, a building needs to receive energy - our cars do this by our supplying them with gasoline. There are choices in what types of gasoline you might purchase, some your vehicle is designed to operate optimally on, and some are actually designed to produce fewer emissions when consumed. Similar to different types of fuels with different emission factors, fuel prices also vary from gas station to gas station.

These two elements - the kind of fuel and the cost of fuel are similar to the energy that you need to supply to your building so it can operate. We call this supply side management or energy procurement, and when we buy energy smartly, we can also impact the emissions and cost of energy supply for our buildings.

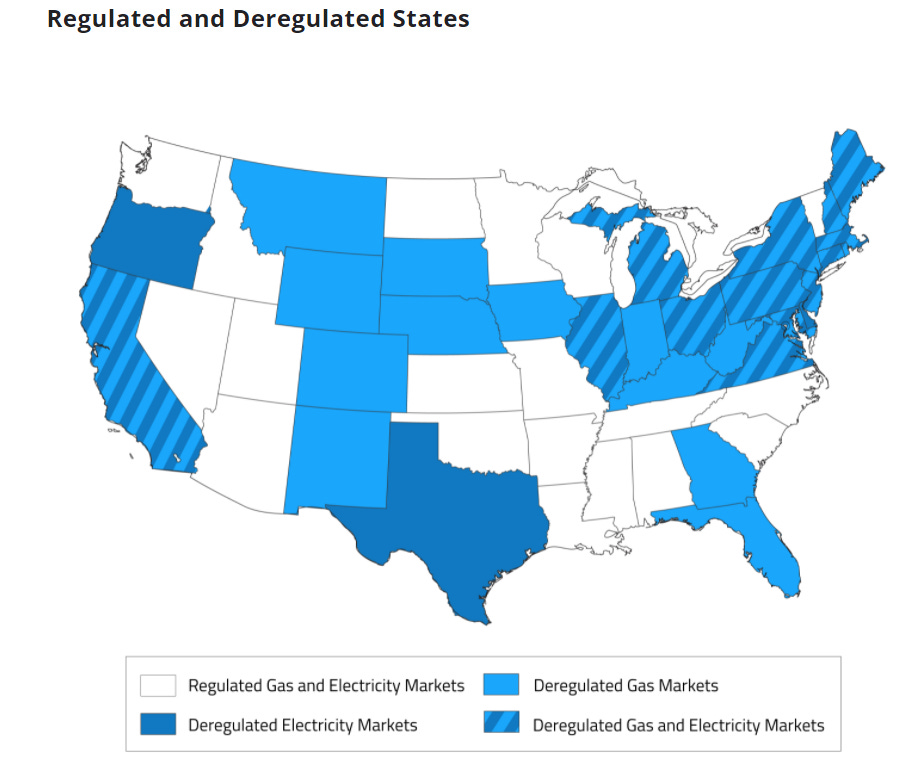

On the supply side, there are several things we can do that impact both the cost and impact of the energy for our portfolio. For example, some states offer supply choices, and these deregulated states allow the consumer to purchase gas or electricity, or perhaps even both, from a variety of supply sources.

In a traditional energy supply broker model, you are likely engaging with a company that is going to negotiate a contract for you for the supply of gas or electricity for a specific period of time. There are many ways this could be structured; for example, it may be a fixed rate, it may be a dynamic rate, the rate may be tied to an index, or it may even be purchased in blocks. I’ll save those explanations for another article.

To start this evaluation, an energy broker will ask for energy bills and determine the amount of energy you need to purchase while also looking at the market commodity rates for that energy type.

At this point, the energy broker will provide you with a quote. In most traditional models, they are going to tell you that there is no fee for the service - or if they are being somewhat transparent, they may advise you that their fee is actually baked into the rate you are paying for the supply. This means a percentage of what you are paying for electricity is actually being collected by the supplier and paid back to the broker. There is always a fee - they just may not be showing it to you. It is essential that you understand how the price is structured.

Now that we understand how the fee structure is incorporated, another little angle in the energy market is the suppliers control the markets. In doing so, they will not provide pricing to more than one broker. Effectively this eliminates the ability to bid broker against the broker for the same energy supply.

You can still compare brokers, however, and really that starts by understanding what their actual fee structure is and how much of that fee they are taking for themselves, effectively passing their fee onto the property owner. Other ways to compare broker against broker is to evaluate the customer service, the contract management practices, the technology, and the number of suppliers they can obtain bids from in a given market, as well as what markets they can actually do business in.

This is where a clean energy strategy can begin to take root and is a differentiator amongst energy brokers. To this point, notice that I really have not deeply discussed the carbon impact of the energy source being transacted. I also want to be clear that natural gas is still a fossil fuel; there is no clean energy path for natural gas. That commodity is a pricing exercise only.

Electricity is a bit different in that it can be generated from fossil fuel sources or renewable energy sources. The energy generated from renewable energy sources can provide the portfolio owner with a strategy to reduce greenhouse gas impacts simply by buying smarter - without making operational or equipment changes.

The second area for opportunity in regards to energy surrounds the actual energy performance of the asset. Even the best-built buildings can drift, and over time assets perform more poorly than design. This is where benchmarking and tracking energy performance over time can provide an opportunity to recognize and reduce inefficiency.

In order to track performance, you need performance data. The more granular, the more insight the data can provide. The problem with utility data, however, is that it is messy. Different units of measure are used, sometimes within the same utility, and different billing periods are used. On top of the complexity of data is the availability of data to make meaningful comparisons against. It takes large data sets of like-buildings in like locations to compare and understand how the building is performing.

Once the data is in hand and you understand where to look based on benchmarking, we still need to visualize the data in a way that allows it to be explained to others in order to win support for the project. This may also include gathering additional data points, which lead to a projection of ROI.

Once an efficiency measure is identified and approved, the measure must be implemented. In layman’s terms - you have to now fix what you found. Post install, the actual ROI needs to be proven and the entire process re-evaluated to produce improved results for the next project.

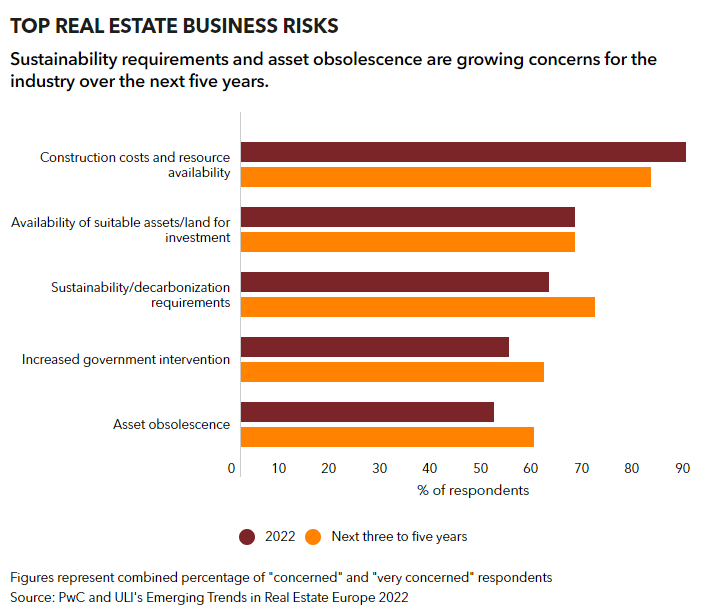

Combined with a solid preventative maintenance strategy and capital equipment replacement strategy, we can see the impact on the asset’s value. Inverselyfailure to maintain equipment allowing assets to reach obsolescence can reduce or even make it nearly impossible to transact an asset without deep discounting.

An example of this in action occurred last year when Brookfield Asset Management purchased a 12-property, 2.4 million square foot office portfolio in DC from WashREIT. The $766 million purchase price traded at a low-8 cap rate and at $325 per square foot, 20 percent below the mid-6 cap rate and $410 per square foot asking price at the time, according to Green Street. Green Street attributed the loss in asset value to the quality of the properties, including that they would require significant time and higher capital to be re-tenanted.

Asset obsolescence is not a new phenomenon; however, considering the number of existing assets currently in the built environment and how these assets compare to recently built assets, it promises to be an increased risk in the future. In most cases, the full transition risks are likely not being adequately factored in when making buy/ no buy decisions, to the point that we may be looking at 15-20% declines in price in 24-36 months, according to Peter Papadakos of Green Street.

One has to look no further than the life cycle of the enclosed shopping mall in towns across the United States. Simply put, the enclosed mall is no longer considered a viable long-term asset, and those left holding these assets potentially are looking at the erosion in their investment. While the cause may be slightly nuanced in the case of the enclosed shopping mall, the end result may be similar as we shift away from carbon-based energy sources.

A solid ESG program interfaces with both the due diligence and development phases of assets to help mitigate these risks. Factoring into the Pro-forma the potential opportunity and providing evidence to discount when warranted.

You can help reduce the impact of the built environment by sharing this blog with your peers. Together we can impact the 39% of greenhouse gasses attributed to the built environment. It starts with awareness, and we succeed with teamwork.

Stay well!

Chris Laughman is the ThirtyNine Blog author, a blog dedicated to reducing the impact of the built environment. When not blogging, Chris is helping the real estate industry reduce energy and water impact as the Vice President of Sustainability for Conservice, the Utility Experts. Whether Multifamily, Single Family, Student Housing, Commercial, or Military, we simplify utility billing and expense management by doing it for you. Our insight into your utility consumption provides an opportunity to identify risks. Leveraging innovation and experience, we ignite solutions with real impacts and track performance to ensure the trendline stays laser-focused on the goal. At Conservice, we have developed a true bill-to-boardroom solution to help truly make a difference. We have before us a tremendous opportunity. Standing shoulder to shoulder, we will get this done. Contact me at claughman@conservice.com for more information.

Follow us at:

Twitter: @BlogThirtynine

Instagram: ThirtyNine_Blog