ESG Engagement Pros and Cons

Have you considered how the delivery of your investor engagement strategy can impact perceived value of your ESG program?

This week, we are looking at the PRI paper, “How ESG Engagement Creates Value for Investors and Companies,” and specifically the challenges of ESG engagement through the lens of both organizations and investors. For the full paper, see this link.

I am often contacted by organizations or individuals trying to make sense of ESG. Many recognize that it is an essential element in their corporate strategy, but how should they best approach it? What is the formula? Where should we start?

If you have read any of my other articles, you know I am a strong advocate for building ESG on a foundation of quality data. This is the single common key amongst every organization. If you don’t have solid data, you are setting yourself up for failure. However, after identifying your data sources, the next steps become very organization-specific. Much like real estate itself, in that no two properties are alike, no two organizations are alike as well. While there are lessons to be learned in evaluating what other organizations are doing, most organizations have unique stakeholders both internally and externally.

Because of this, if you could develop an ESG program in a vacuum, the next logical step would be to conduct a materiality assessment. To study your organization its stakeholders and understand what is truly important. ESG is a large umbrella, and there are many paths to go down. Without a clear strategy, there is a potential of doing just a little bit of everything, but not enough of anything. As your organization’s ESG program matures, you will discover which paths make sense, but not all paths make sense to all organizations.

The PRI article I am focusing on this week takes an additional step beyond the materiality study and addresses individual and collective investor ESG engagements from corporate and investor perspectives.

While there is clear evidence that ESG programs can create shareholder value, poorly executed engagement can reduce that value and even reduce the perceived value of the program.

One of the most critical elements of this study highlights the importance of internal data, how that data is managed to identify opportunities, and how the organizations seamlessly pull that data in for ESG reporting purposes. The more disconnected the data is from comprehensive visualization and reporting, the more problematic for an effective engagement strategy with investors.

It is also vital that organizations provide the ability to demonstrate that they are acting rather than being acted upon by their data. An effective engagement strategy can demonstrate to investors how risk is being identified and opportunities are being acted upon rather than merely following the pack. Similarly, engaging investors about KPIs, including explaining why those KPIs are relevant, was key to effective engagement.

Looking more closely at the actual engagement strategy itself, let’s start with individual investor ESG engagements, including face-to-face and one-on-one dialogues. From the corporate perception, there was consensus that these engagements, as one might expect, proved to be effective in addressing multiple ESG issues and allowed for the avoidance of misrepresented ESG performance by third parties. These interactions also allowed for relationships to be stronger through building trust and familiarity that resulted from these engagements.

Investor perceptions of individual engagement efforts echoed the effectiveness of these interactions by expressing they increased a feeling of alignment of engagement goals with internal ESG and engagement policies. By talking through the engagement, they were left with an impression of a more proactive program that allowed them to better understand how an ambiguous ESG score actually applies to the organization.

The downside of these individual engagements from the corporate perception was the time and resources required for individual engagements. Often investors had the same questions, which meant answering the same question repeatedly. Overall, this approach was more costly and consumed more time, particularly as the number of requests increased.

Investor cons included potentially low shareholding investors may not receive the same attention as high shareholding investors. There was also a concern that the increased cost and resources associated with individual engagement could have been better spent maintaining the continuity of the engagement.

The other engagement evaluated was a collective investor approach in which a less individualized approach was utilized. From the corporate perspective, this approach allowed leveraging of resources to engage more investors at less cost. They also felt it provided a higher level of ESG expertise which in turn could lead to the investor group also increasing their level of expertise.

From the investor perspective, organizations using a collective investor approach provided a higher level of influence and a more organized portfolio or collective asset feel. This provided for more relevant systematic approaches and addressed marketplace issues. Of particular interest was the ability to stick to themes that the investors were looking for. This approach also provided cost savings on monitoring in the eyes of investors.

Just as the individual approach recorded cons, so does the collective approach. For corporate perceptions, there was a perceived lack of interest from investors for overall ESG management activities as they felt the programming was themed versus effective. When investors failed to coordinate their interests, organizations perceived higher coordination costs and believed that shareholders with fewer shares might attend meetings and attempt to sway strategy despite having significantly fewer shareholdings.

Investors perceived that the collective approach potential produced too broad of an international focus and may not be relative to their national investment strategies. They also perceived the risk of free riding and that this approach could be a time-consuming process if investor views were not in sync.

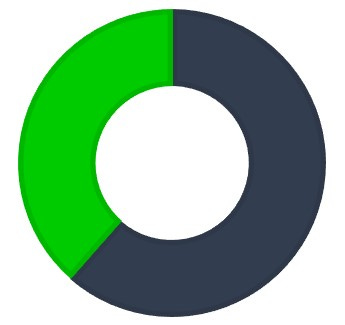

Understanding the pros and cons of each approach provides insight into developing engagement strategies and avoiding pitfalls. Overall, organizations tend to favor the individual approach as it allows the program to be tailored to specific investors, particularly those with more influence. This strategy also really allows for one-on-one conversations in which particular questions can be addressed, and specific ESG strategies can be discussed in detail. Tailoring a delivery to multiple investors has the potential to lose messaging and impact.

You can help reduce the impact of the built environment by sharing this blog with your peers. Together we can impact the 39% of greenhouse gasses attributed to the built environment. It starts with awareness, and we succeed with teamwork.

Stay well!

Chris Laughman is the ThirtyNine Blog author, a blog dedicated to reducing the impact of the built environment. When not blogging, Chris is helping the real estate industry reduce energy and water impact as the Vice President of Sustainability for Conservice, the Utility Experts. Whether Multifamily, Single Family, Student Housing, Commercial, or Military, we simplify utility billing and expense management by doing it for you. Our insight into your utility consumption provides an opportunity to identify risks. Leveraging innovation and experience we ignite solutions with real impacts and track performance to ensure the trendline stays laser-focused on the goal. At Conservice we have developed a true bill-to-boardroom solution to help truly make a difference. We have before us a tremendous opportunity. Standing shoulder to shoulder, we will get this done. Contact me at claughman@conservice.com for more information.

Follow us at:

Twitter: @BlogThirtynine

Instagram: ThirtyNine_Blog